Table of Contents

Introduction

An emergency fund(EF) is a very crucial aspect of financial planning that can help you weather unexpected expenses or income disruptions. It provides a financial safety net that can give you peace of mind and prevent you from going into debt when unexpected expenses arise. As a part of the holistic approach to Personal Financial Management, it forms one of the most critical links the in financial jig saw puzzle that one has to manage in life. I have seen quite some people who have to undertake substantial debt in dealing with a cash crunch in a jobless situation or some unexpected medical emergency. While you may ask, Is this required for me? Is this what I need? Why do I need emergency funds, I am pretty stable in life…. The simple answer to all this is YES! Everyone should have their version of an emergency fund no matter how big or small your income is.

What is an Emergency Fund?

An emergency fund is a cash reserve that you keep in a separate account, such as a savings account, to cover unexpected expenses. These expenses might include things like medical bills & job loss. The funds should be easily accessible and not tied up in investments or other long-term savings where access to the same is difficult.

Where Should You Use This Emergency Fund?

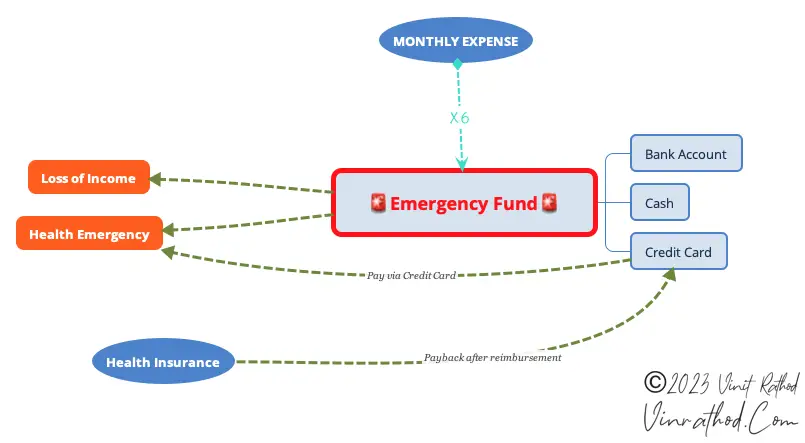

The simple answer to this is emergency funds should be used only for 2 reasons.

- Loss of Income/ Loss of Job for Business.

- Health/Medical Emergency.

There are different ways of saving for the same we shall discuss this in a later section. But the key point to understand is also where not to use this fund. Apart from the above 2 reasons your emergency funds(EF) should not be used for anything else. It’s a big no-no for your travel plans or buying new appliances or even debt repayments. Yes, you read that right, no debt repayments as well. I am sure many financial gurus will tell you otherwise but using your EF in debt repayment is a very bad idea. One can never know when tragedy strikes, and using this ready cash will help you save on taking on new debts or increasing your existing debt.

How Much Should You Save?

In an ideal world, one should save an amount which is at least 6 months of your monthly expenses. Say for example your monthly expense including your EMI, groceries, insurance, travel, etc. stands at about ₹50,000/-(Fifty Thousand) per month. Then multiply this amount by 6 and you will need ₹3,00,000/-( 3Lakhs) as an Emergency Fund(EF). Now what is this for? This is only for your loss of income part. Then what about Medical Emergencies? Yes, you can use a part of it but there is another way in tacking your medical emergency.

Medical Emergency

This is where I found the hard way that conventional wisdom for an Emergency Fund disappointed me. Many hospitals and nursing homes in India have now accepted cashless mediclaims(Health Insurance). This cashless market has caused an artificial surge in the cost of medical treatments and hospitals often overcharge. Now the Insurance companies are no fools and are slowly catching up with these heavily inflated bills. In many such cases, your insurer may reject your claim leaving you to fend for yourself – Remember the Debt I was talking about earlier? this is how it starts.

A solution to this: Apply for a Credit card. One can apply for credit cards with a much higher limit if your credit score is well maintained. Usually, Banks offer Premium Paid Credit cards which will have a higher credit limit when compared with other card options available to you. I have calculated the average bills for a range of treatments and they come to 5 lakhs. Very rarely have I seen such emergency procedures cross this value mark of 5 Lakhs in India.

Settle the hospital bill with a credit card and then submit your claims to your insurance company. This way hospitals will not overcharge or create inflated bills and your chances of a claim getting rejected are reduced drastically. There may be some scenarios where insurance companies will reject some items in your bill but that burden should not be so heavy and that much part you can replenish at a later date to you EF.

Once your hospital bill is all paid up and you are back on your feet you will receive your credit card bill which will have to be paid by the due date. By that day if you have received compensation from the insurance company then well and good, you can pay off your card bill, and that’s the end of it. But if not or say the insurance company has not paid the full amount, then this is the time when you should dip into your EF and make a withdrawal.

This way you have utilized credit offered by the bank for your bills and not touched your EF until you have to. Who knows you might require EF cash for another round of treatment which may not be covered by your health insurance, at that time you might need every penny of your EF and with this approach, you are leaving yourself with enough legroom to wiggle through such a tight spot.

Modes of Emergency Funds

There are in my opinion 3 kinds of emergency funds you should plan for

- Liquidity in Bank account – Ready with Debit Card & Cheque Books.

- Credit Cards – There are credit cards that you will never use for any purpose other than a medical emergency as explained above.

- Cash – This is the most risky but also one of the most preferred modes of funds that should be available to you

What Bank Should You Prefer?

Ideally, you should consider a bank that has the widest coverage across the country and one that has easy connectivity in the remotest of places in India. I have personally selected the State Bank of India since it has the best branch coverage across India and also since it is a nationalized bank I am assured of the bank’s survival in the event of some big financial or economic meltdown. The important thing to keep in mind is that Your bank should offer multiple ways of withdrawal. You don’t want to waste time and energy trying to access your Emergency Fund. That would defeat the whole purpose of such a fund. It is perfectly fine if you want to have multiple banks where you can split your funds. If your requirement for EF is above 5lakhs then it is advisable to split this amount into 2 different banks. Since Reserve Bank Of India(RBI) will guarantee your deposits only up to 5lakhs in case your bank undergoes insolvency and the last thing you need is your emergency funds going down the drain with an insolvent bank.

Also, You and your loved ones should hold that account in either survivor mode so that they can make financial decisions with ease if you are unable. I have taken Cheque Book facility, Internet Banking, Mobile Banking, UPI Banking, and 2 separate debt cards for my EF account. One card with me and one with my wife. But do keep in mind, you are not supposed to carry your emergency fund cards or cash with you in person. Cash, Debt Cards & Credit Cards meant for Emergencies should be safely kept under lock and key.

Building an Emergency Fund from Scratch

Most of you out there will not be in a position to create an Emergency Fund right away. You will need time, dedication & patience to slowly build this fund. First, you will need to work out in your scenario how much funds you will require. Here it is important to start small. Right from the beginning if you target 6 months it will seem like a mammoth task and demotivate you before you even begin. Aim small miss small.

Start with one month’s expense as a reserve target. See how much in your monthly budget you can afford to save and forget. let us assume your target is for ₹50,000/- and every month you can comfortably save ₹3,000/- Create a Recurring Deposit(RD) with your bank account or just open a new Bank account that will act as your dedicated Fund Account and make it a point to add this ₹3,000/- to this account dedicatedly. Do this for a year and by the end of the 12th month you will have ₹36,000/- with comfort. Let us say you got a small bonus near Diwali that you can spare and add to your fund account.

Now there are 2 types of people I have seen :

- Who will get motivated by the progress and become aggressive and reach their final goal?

- The ones who will get tempted to use the savings for some or the other irresistible reason

If you are the second type of person, It’s time to change buddy.

Now to better manage your Emergency Fund, there is a way to optimize your savings. Let us say you have reached your target of ₹50,000/- and are happy with it or maybe you want to grow it slowly. You can opt for something known as Sweep-in Sweep-out Facility. Here a fixed amount of money is kept as liquidity in your account and above a certain threshold that money is automatically converted into a Fixed Deposit. That way you make a little bit more in interest earnings when compared with interest rates for money lying idle in your account. Every bank has a kind of offering for this, you should check it out with your bank and understand the product properly. I use this Sweep-in Sweep-out Facility with Last In – First Out feature. But beware opting for this will become costly if keep withdrawing and depositing cash in your account frequently.

Once you have reached your target amount, that’s it. It’s done don’t fuss with it, don’t mess with it, and don’t fall prey to the bank’s fancy salesperson talking about what better you can do with this money. Build & Create the fund and forget about it. Like it doesn’t exist. Revise your Fund requirement every 2 – 3 years to see if you need to increase it based on your monthly expenditure. If your monthly outflows have increased then it is time to increase your Emergency Fund as well. If not then don’t bother with it, go to bed every night with peace knowing you have created the safety net successfully and in your hour of need you will not require any of your family or friends to help you out financially.

How Do You Replenish Your Emergency Fund?

If you have to use your emergency fund, it’s important to replenish it as soon as possible. This might mean cutting back on discretionary spending or finding ways to increase your income. It’s crucial to rebuild your emergency fund as quickly as possible so that you are prepared for any future unexpected expenses.

Conclusion

Having an emergency fund in place can provide peace of mind and prevent you from going into debt when unexpected expenses arise. By setting a savings goal, committing to saving a certain amount each month, and automating your savings, you can build a financial safety net that will help you weather unexpected events and income disruptions. Remember, it’s never too late to start building your emergency fund, so start today and prepare for the unexpected.

Template

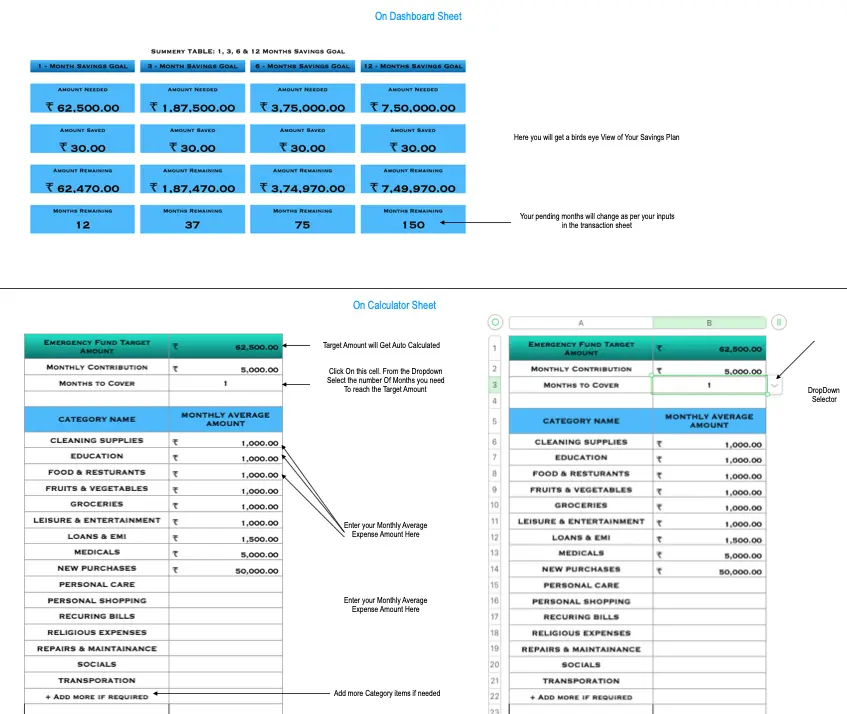

For all Apple Mac users, I have made a simple to understand & easy to use template where you can easily enter some basic data and get results.

System Requirements: Apple Mac Devices

Software: Numbers(Spreadsheet app very similar to MS Excel & Google Sheets)

Feel Free to Download and use the template. To Download Click Here.

One of the Bloggers I Feel has a bit different perspective on what an emergency fund is. Visit Manish Choudhary’s Page here

Good information. Very well written in detail.

Very well written!

Saving should be the priority apart from the income earned.

A contingency fund is a must in today’s uncertain times

All points very well covered

Very well written!!

Contingency fund is a must in today’s unpredictable life

Saving should be the top most priority as inflation will be of concern

Save and invest for the coming days